Content

Check the course details of the applied financial risk management IIM Kashipur programme here

- Basics of Financial Risk Management

- Risk and Return, Volatility, Correlation, Covariance

- Fundamentals of Bond, Duration, Convexity

- Basics of Portfolio Analysis

- Systematic Risk Estimation

- Basics of Statistics and Probability Theory (as required for the course)

- Forwards and Futures, Hedging, Strip Hedging, Stack & Roll Hedging, Mark to Market, Pricing of Futures/Forwards Using No Arbitrage Argument, Cross Hedging, Basic Risk

- Options (Call & Put), Hedging Using Options, Option Pricing, Implied Volatility, Volatility Smile, Option Greeks, Delta Hedging, Delta-Gamma Hedging

- Interest Rate Derivatives (FRA, Swaps, Overnight Indexed Swaps, Currency Swaps)

- Credit Derivatives

Market Risk Analysis for Single Asset: Non-parametric and Parametric Approaches to Estimate VaR and Expected Shortfall

- Historical Simulation, Monte Carlo Simulation, Simple Variance-based Approach, Risk Metrics, GARCH, EGARCH, GJR-GARCH Models, Extreme Value Theory

- VaR Evaluation: Back testing

Market Risk Analysis for Portfolio:

- Standard Covariance/Correlation Approach, Risk Metrics, Multivariate GARCH Model, Monte Carlo Simulation for the Portfolio

- VaR Evaluation

- VaR of Fixed Income Portfolio: Duration-based Partial Revaluation Approach (Historical Simulation), Cash Flow Mapping

- VaR of Options: Monte Carlo Simulation, Delta Approximation, Delta-Gamma Approximation

Credit Risk Analysis

- Introduction to Credit Risk

- Default Risk, Estimation of Default Probabilities, Agency Ratings

- Credit Scoring and Internal Rating Models Including Credit Scoring for Private Firms, Non-manufacturing Firms, Emerging Markets Firm

- Behavioural Scoring

- Loan Default Prediction (Logistic Regression, Probit, Complementary Log-log, Decision Tree)

- Through the Cycle (TTC), Point in Time (PIT)

- Credit Metrics (VaR Estimation for Non-tradable Loan/Bond Portfolio)

- Structural Models for Estimating Probability of Default and Distance to Default (Merton, KMV)

- Reduced Form Model

- Loss Given Default (LGD), Exposure at Default (EAD)

- Expected Credit Loss, Unexpected Credit Loss, VaR, Economic Capital

- Introduction to Operational Risk with Evidence of Operational Failures

- Estimating VaR for Operational Risk (Aggregate Loss Distribution/LDA) using Monte Carlo Simulation

- Liquidity Adjusted VaR Under Normal and Stressed Market

- Stress Testing, RAROC

- Asset Liability Management in Banks (NII and Duration GAP Analysis in Banks)

Programme Start Date: 17th February, 2024

Programme Start Date: 17th February, 2024

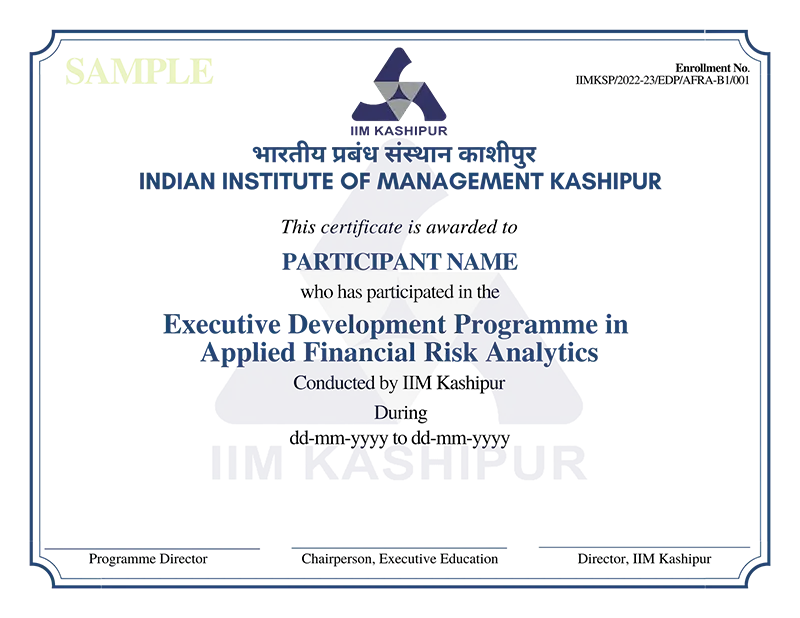

Certificate from IIM Kashipur

Certificate from IIM Kashipur

Direct-to-device

Direct-to-device