Content

The IIM Calcutta Executive Programme in Applied Finance will comprise the following courses*:

*This is an indicative list of topics that will be covered in the programme. Topics can be added or deleted from the list at the sole discretion of the programme directors

- Introduction to financial reporting and statements

- Balance sheet and income statement

- Cash flow statement

- Financial statement analysis

- Cost concepts: Job costing

- CVP analysis and decision making

- Overview of corporate finance functions, financial markets, and Indian financial systems

- Making capital investment decisions

- Net Present Value (NPV) and other investment rules

- Introduction to risk and returns

- Cost of capital: Theoretical background

- Optimal capital structure

- Working capital management

- Dividend policy

- Valuation of shares

- Analysing risk in valuation and methods of calculating country risk premium

- Forecasting cash flow structure of discounted cash flow valuation and detailed cash flow forecasts

- Firm valuation models: Cost of capital and Adjusted Present Value (APV) approach

- Relative valuation equity multiples: P/E, PEG, P/BV, P/Sales, P/FCFE, etc.

- Advantage of value multiples over equity multiples

- Valuation using real options

- Valuation: Venture capital

- Banking and financial services industry

- Financial statements and performance of banks and sources of bank funds

- Retail banking liabilities, corporate banking activities on the asset side

- Assessments of working capital loan products

- Assessments of term loan products

1. Fixed Income Markets

- Fixed income products and their valuation

- Risk associated with fixed income markets

- Term structure of interest rates

- Spot rates and forward rates

- Managing interest rate risk, duration, and convexity

- Trading strategies in fixed income markets

- Benchmark rates and indices

2. Financial Derivatives

- Introduction to derivatives

- Mechanics of future markets

- Hedging strategies using future tutorial

- Determination of forward and future prices

- Mechanics of option markets

- Trading strategies involving options

- Binomial tree and Black-Scholes model

3. Investment Management

- Risk and return estimation of risky assets

- Portfolio formation

- Asset pricing theories

- Macroeconomy and fundamental analysis

- Portfolio rotation strategies

- Mutual funds and ETFs

- Performance evaluation of a portfolio

4. Financial Risk Management

- Introduction to financial risk management

- Market risk: Estimation of VaR and expected shortfall

- Forex translations, transaction, and operating exposures

- Exposure management, stress testing, and extreme value theory

- Credit risk management

- Understanding operational risk

- Economic capital and RAROC

- Basel regulations I, II, II.5, and III

5. Alternative Investment and PE/VC

- What is an alternative investment?

- Real Assets: Nature, valuation, and risk

- Real estate equity investments; Real Estate Investment Trusts (REITs)

- Infrastructure investments and Infrastructure Investment Trusts (InvITs)

- Private equity and venture capital

- Entrepreneurial finance and structured products

Programme Start Date: 13th November 2024

Programme Start Date: 13th November 2024

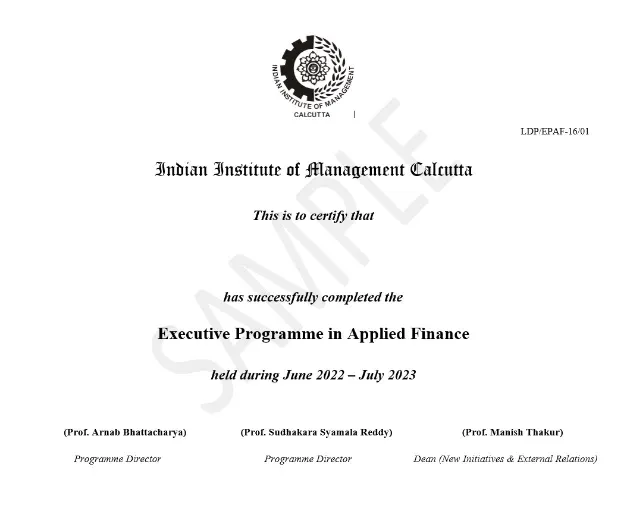

Certificate from IIM Calcutta

Certificate from IIM Calcutta

Direct-to-device

Direct-to-device